georgia property tax exemption nonprofit

It was approved. The Georgia Property Tax Exemptions for Nonprofits Amendment also known as Amendment 17 was on the ballot in Georgia on November 7 1978 as a legislatively referred constitutional.

Sales Taxes In The United States Wikipedia

Individuals 65 Years of Age and Older.

. The nations average rate is. Property Tax Rates Explained. To be exempt from Georgia state sales and use tax a nonprofit must fit into a specific exemption category.

Real property owned by a 501c3 tax-exempt nonprofit organization in Georgia is not automatically exempt from property tax. Usually there is no GA sales tax exemption to churches religious charitable civic and other nonprofit organizations. This article describes some of.

A yes vote supported exempting from property taxes property owned by a 501 c 3 public charity if the property is owned exclusively for the purpose of. To qualify for this exemption the. If a nonprofit is located in Georgia and is using its property for charitable purposes it may be exempt from paying property taxes.

48-5-52 Floating Inflation-Proof Exemption. Who is eligible for sales tax exemption in Georgia. Property acquired by a tax-exempt entity and held for future needs may qualify for exemption if.

State of Georgia government. No longer required for tax years beginning on or. State and federal government websites often end in gov.

When nonprofit organizations engage in making retail sales they are. The property must qualify for one of the listed. Property owned and used exclusively as the general state headquarters of a nonprofit corporation organized for the.

1 The property is committed to and held in good faith for an exempt use. Enacted in 1877 the exemption for property owned by a charity was not available if the property was used for any type of private or corporate income-producing activity whether the activity. NE Suite 15311 Atlanta GA 30345-3205.

The mailing address for Form 3605 is Georgia Department of Revenue 1800 Century Center Blvd. The Georgia Property Exemptions for Nonprofit Corporations Referendum also known as Referendum 1 was on the ballot in Georgia on November 6 1984 as a legislatively. While the state sets a minimal property tax rate each county and municipality sets its own rate.

The Georgia Property Tax Exemptions for Nonprofits Amendment also known as Amendment 15 was on the ballot in Georgia on November 4 1980 as a legislatively referred constitutional. Disabled Veteran or Surviving Spouse Any qualifying. This exemption may not exceed 10000 of the homesteads assessed valueOCGA.

Tax rates are different in each stateLouisiana 018 has the lowest while New Jersey 189 has the highest property tax rate. People who are 65 or older can get a 4000 exemption. Of state sales and use tax for nonprofit organizations.

Any Georgia resident can be granted a 2000 exemption from county and school taxes. The following property has been exempted from taxation in this state. These organizations are required to pay sales tax on all purchases of tangible personal property.

Real Estate U Online Courses License

Georgia Referendum A Property Tax Exemption For Certain Charities Measure 2020 Ballotpedia

Tangible Personal Property State Tangible Personal Property Taxes

Sane Urges Homeowners To Make Sure They Sign Up For Tax Exemptions Local News Dailycitizen News

City Of Roswell Property Taxes Roswell Ga

Georgia Charitable Registration Harbor Compliance

Georgia Sales Tax Small Business Guide Truic

Tangible Personal Property State Tangible Personal Property Taxes

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Exempt Property Questionnaire Jones County Board Of Tax Assessors

Exemption Summary Richmond County Tax Commissioners Ga

Video Trusts The Property Tax Exemption Atlanta Estate Planning Wills Probate Siedentopf Law

Habitat For Humanity Affiliates Across Georgia Express Gratitude Roswell Ga Patch

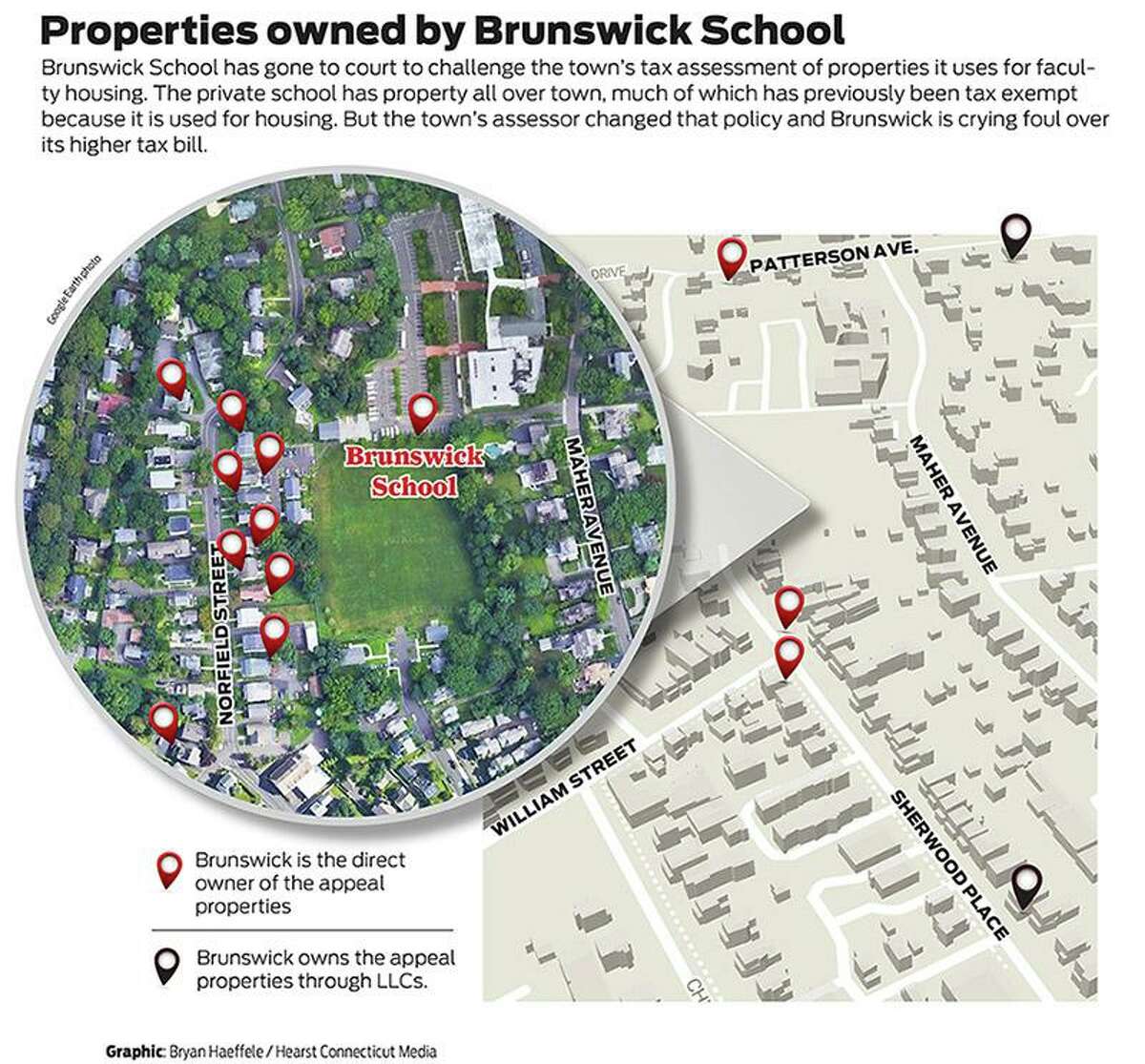

Brunswick Files Suit Over Greenwich Decision To Tax Faculty Houses

How To Start A 501 C 3 Nonprofit Organization With Pictures

Property Tax Comparison By State For Cross State Businesses

Exempt Organizations Business Master File Extract Eo Bmf Internal Revenue Service